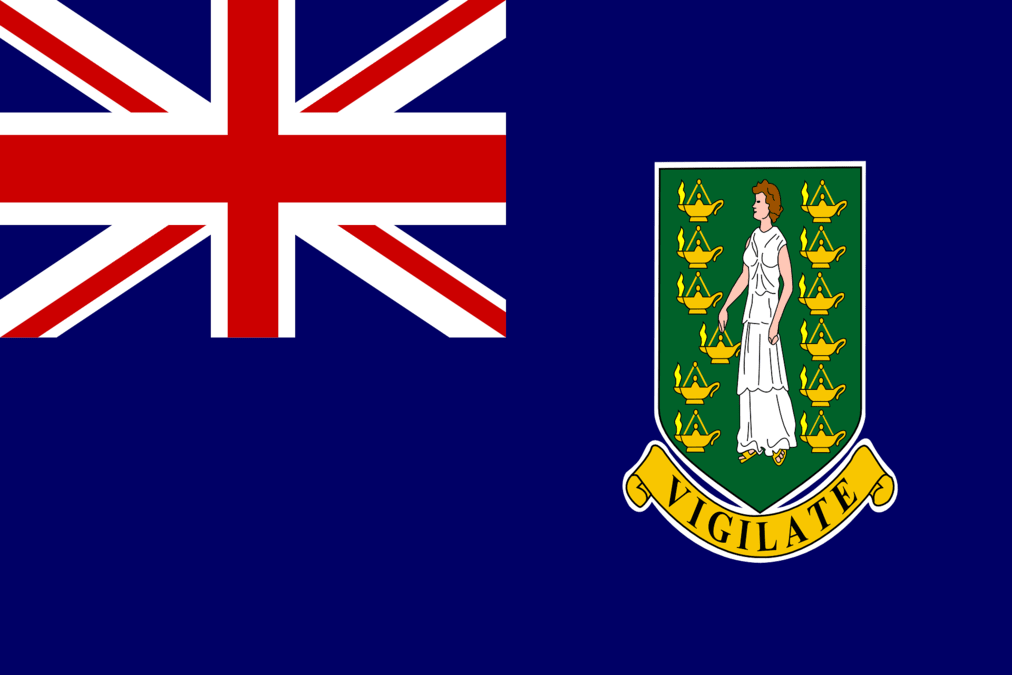

Incorporating a business in the British Virgin Islands (BVI) offers numerous advantages that make it an attractive choice for entrepreneurs and businesses worldwide. With its favorable business environment, tax benefits, and robust legal framework, the BVI provides a solid foundation for success. In this article, we will explore the advantages of incorporating in the BVI and how they can benefit your business.

Tax Benefits

The British Virgin Islands is renowned for its tax-efficient structure, offering significant benefits to businesses. Some of the tax advantages of incorporating in the BVI include:

- No Corporate Income Tax: BVI does not impose corporate income tax, allowing businesses to retain more profits for reinvestment and growth.

- No Capital Gains Tax: There is no capital gains tax on the BVI, providing opportunities for businesses to realize gains without the burden of additional tax obligations.

- No Withholding Tax on Dividends: Dividends distributed by BVI companies are not subject to withholding tax, enabling efficient repatriation of profits to shareholders.

- No Estate or Inheritance Tax: The absence of estate or inheritance tax in the BVI ensures smooth intergenerational wealth transfer and succession planning.

Asset Protection and Privacy

Incorporating in the BVI offers robust asset protection and privacy measures, ensuring the security of your business and personal wealth. Key advantages include:

- Limited Liability: BVI companies provide limited liability protection, separating personal assets from business liabilities. This safeguard shields shareholders from personal financial risk.

- Confidentiality: The BVI maintains strict confidentiality laws, protecting the identities of shareholders, directors, and beneficial owners. Confidentiality provisions offer privacy and discretion for businesses operating in sensitive industries or seeking to protect their competitive advantage.

- Trust Structures: The BVI is known for its well-established trust laws, making it an ideal jurisdiction for setting up trusts. Trust structures offer enhanced asset protection, estate planning, and wealth management opportunities.

Ease of Doing Business

The BVI provides a favorable business environment, facilitating ease of doing business and fostering economic growth. Key advantages include:

- Simple Incorporation Process: The process of incorporating a company in the BVI is straightforward and efficient, with minimal bureaucratic hurdles.

- Flexibility and Versatility: BVI companies enjoy flexibility in structuring their operations, capital, and shareholder arrangements. This versatility allows businesses to adapt and scale their operations as needed.

- International Recognition: The BVI is internationally recognized as a reputable and well-regulated jurisdiction, which enhances the credibility and reputation of companies incorporated in the BVI.

- Professional Services: The BVI boasts a robust network of professional service providers, including law firms, accounting firms, and corporate service providers. These professionals offer expertise and guidance to support businesses throughout their operations.

Incorporating your business in the British Virgin Islands (BVI) offers a range of advantages that can significantly benefit your company. From tax benefits and asset protection to confidentiality and ease of doing business, the BVI provides a favorable environment for entrepreneurs and businesses.

Interested in incorporating your company in the BVI? Click here to get started.